The US economy has been in a softened, recessionary mode since last year. Consumers have been dealing with high prices and shaky job prospects. Budgets are being challenged and spending has taken a conservative turn. Shoppers more than ever are frequenting three or more channels for key categories, buying only when they feel they have a good price.

With the rising cost of milk, eggs, meat, and corn contributing to the biggest jump in food prices in 17 years, consumers have started to feel the pinch.

Some shoppers, already dealing with falling home values and rising fuel costs, are finding creative ways to save money. They are now opting for cheaper ingredients and private-label goods and are leaning more heavily on discount grocers, which has led U.S. retailers to offer In-house brand & private-label goods at a significant discount. This is the time when U.S. retailers reported their slowest monthly sales in January 2008. Restaurant diners, who have been eating out less frequently, will likely face even higher prices on menus.

The food prices are rising for a number of reasons. A growing middle class in Latin America and Asia can afford more meat and milk, which has driven up the demand for grain to feed cattle and hogs. A drought in Australia in 2006 reduced the supply of milk available to Asia, further pushing up the cost. Increasing global demand for U.S. wheat and poor harvests in other wheat-producing countries have caused wheat prices to soar to record levels last year.

Demand for grain-derived ethanol, driven by government incentives, has helped push up corn and soybean prices, which in turn have raised the cost of many products derived from these crops, like oils, and high-fructose corn syrup, a sweetener used in everything from soft drinks to ketchup. The egg prices too were up by 19.5%, milk rose by 13.3%, chicken by 10%, navel oranges 19.8%, apples 11.7%, dried beans up 11.5% and white bread missed double-digit growth in 2007 as compared to 2006. On top it of it; rising fuel costs are making it more expensive to transport food from the producers to stores, consumers, and restaurants.

Retailers are feeling the pressure, and most feel as though they are already in a recession and are trimming their costs everywhere they can, reducing advertising, delaying new hires and renovations, curtailing employee travel, and saving gas for their delivery trucks. Not only had this but Macy's, the second-biggest US department-store chain, cut 2,300 jobs as January 2008 sales dropped 7.1% over the previous month. Even Wal-Mart’s sales rose only 0.5% in January 2008 as opposed to the forecast of 2%. Even manufacturers like Kraft and Kellogg are boosting ad spend to tout the brand to consumers as an ‘ultimate indulgence’, so that recession weary consumers can treat themselves and their families to the best.

A number of initiatives have also been taken by food retailers to attract the budget-conscious customers with product improvements, cost cutting, and strict inventory management. Burger King and Wendy’s are increasingly offering more food for less money by offering double cheeseburgers on dollar menus copying the same strategy of McDonalds. Taco Bell is offering Gordita Supreme, one of the largest menu items, for 99 cents which was earlier priced at $1.50. Likewise, Quiznos sandwich chain launched a line of $2 small flatbread sandwiches called Sammies in November 2007, having a combo meal with two Sammies, a medium drink and either chips, a side salad or a bowl of soup for $6.

This is how the manufacturers, retailers, and shoppers are playing their roles in the current U.S. recession, which is similar to the role they have played in the 2001 recession. An aspect, which needs to be pointed out, is that the retailers, by defeating brands with generics and private label, are changing the way the consumers perceive value. There has to be some cost-effective program for customers, as price alone will lead to their downfall. Manufacturers offering new consumer choices while retailers quickly counter with private label or a generic brand then engage in pricing that defeats the manufacturer. Is there a retailer - manufacturer war?

By Vikash Ranjan

Friday, February 22, 2008

US Recession Pinching End Customers

Thursday, February 21, 2008

LG’s Marketing Strategy: ‘Brands that speaks for itself’

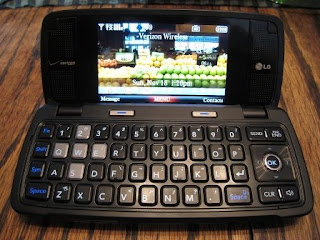

LG has developed a unique strategy to attract customers to its mobile phones in order to differentiate itself from its competitors. The company is very clear about their target market and their approach will most certainly get them the response they are looking for for. Unlike other players, the brand name very clearly signifies the kind of customer it is designed for.

LG had introduced a smart phone named ‘Voyager’, which offers a great deal of functions at a competitive price. Voyager, which means an explorer or traveler, has all the functions that a professional always on the move would require to execute his official work with ease.

Similarly ‘Venus’ was introduced keeping women in mind and another phone ‘Prada’ named after the well-known Italian fashion company, was designed for people who like to make a style statement. LG has now launched a camera phone ‘Viewty’ that flaunts its 5.0-megapixel camera and xenon flash. This adds strength to the argument that camera phones are now a serious option for those looking to ditch their dedicated camera for the convenience of carrying only one device. LG Viewty has recorded impressive sales performance of over 310,000 units since its introduction. It is also great news that Viewty has been launched in India too, so let us wait, and watch what results this phone will have in Indian market.

LG is also trying to capture the smart phone market by launching their new phone ‘Voyager’, (still not launched in India) but the phone lacks features like Wi-Fi, built-in e-mail client and an option to synchronize contacts and calendar between the PC and the phone, which are the basic features of smart phones but it is very competitive in price and multimedia features. It is a good combination of multimedia and smart capability phones.

By Shashi Pandey

Monday, February 18, 2008

Boom Times Ahead for Packaged Drinking Water

During my school days in Chennai (Madras), when I used to play cricket on the roadside, I just had to reach out next door for gulping some water to quench my thirst. But nowadays the situation is totally different, you will definitely find the next door, but with a cost, a sachet of 200ml water would cost you not less than a rupee with no guarantee that it’s the safest water that is fit to drink.

India is set to become the third largest economy after the US & China by the year 2020 with its current growth rate. Given the scenario, I would say boom times are ahead for packaged drinking water. As per the available data the total number of ISI certified packaged drinking water companies in India are close to 1450; and unauthorized companies are over 2000. In India the southern state of Tamil Nadu is the biggest market. Roughly, in Tamil Nadu alone there are about 450 authorized and 300+ unauthorized companies selling water to this water scarce state and making one-fourth of total sales in India.

The current Indian market size of bottled water industry is Rs. 18 billion and is poised to grow at a staggering rate of 40 percent per annum.

The history of bottled drinking water dates back to the year 1583. The Romans are said to be the inventors of bottled drinking water, who first exported it to King Henry II of France. It became more popular in the West during the 1920s and developed rapidly.

In India, bottled/packaged water is still not perceived as a product for masses; so what, look at the facts, it gives you a totally different picture. It is the world’s fastest growing market, the per-capita bottled water consumption is less than five liters a year as compared to the global average of 24 liters.

The industry has seen many new entrants, year on year several small players have entered the trade in India to capitalize on the craze, there has hardly been any involvement of statutory body in defining specific standards. Recently, the Bureau of Indian Standards (BIS), the highest governing authority in India, has got involved in the process to provide check on the new entrants. Some serious doubts also have been raised about the safety of so-called bottled water available.

The new entrants with their low pricing and aggressive marketing strategy, are here to capture the huge middle class population of our country, I would be wrong in saying middle class, infact its all section of people who are being targeted. Can you believe that in a survey conducted it has found that truck drivers form major consumers of packaged drinking water? Penetration in rural areas is another significant factor that is likely to play a key role in the development of the bottled water trade.

In comparison to global standards India’s bottled water segment is largely unregulated. However, with the stringent measures adopted by BIS would make this industry a more regulated and would see more growth in the near future.

By Vijai Kumar G